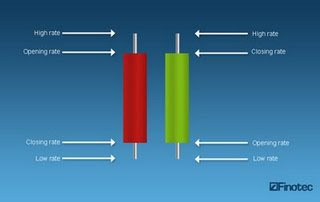

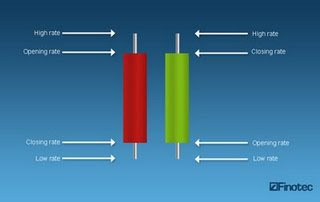

In many ways, the candlestick chart is similar to the bar chart. It displays more or less the same information (high-low price range as well as closing and opening prices) but in a different format. The main difference is that on a candlestick, it is the block, or body, in the middle that shows the range between the opening price and the closing price (and not a dash as in the bar chart) and its color indicates the direction of the market for that particular period of time.These types of candlesticks are called “Japanese” candlesticks because they originated in Japan centuries ago, where they served as a rice trading and counting technique. The technique was then discovered by a Westerner and became a big hit in the world of finance. Today candlesticks are used for almost any price representation over time: for instance, you can view the price evolution of a given share price on a candlestick stock chart.Traditionally, candlesticks bodies were either black or white (white or unfilled when the currency closed higher than it opened, and black or filled when the currency closed lower than its opening price). However, candlestick charts now exist in Technicolor! Actually, they can be either green or red: green when the closing price is higher than the opening price; and red when the closing price is lower than the opening price. As you will notice along your journey to forex trading, those two colors are not only for aesthetic purposes: using red and green candles enables the eye to spot trends and reversals much faster on the graph.Here’s what a candlestick looks like:A candlestick is made up of: a body and shadows (upper and lower). The colored section of the candlestick (red or green, black/white) is called the body and it shows the open/close range. The vertical lines above and below the body are called the shadows and they show the high and low/range.If the price closes above the opening price, the body is usually colored in green (or white in a traditional candlestick chart). If the price closes underneath the opening price, the body is usually colored in red (or black).Also, long bodies are a sign of intense buying and selling activity. They are many types of candlesticks that vary according to market conditions. One of them is called “spinning tops.” This describes small bodies with long upper and lower shadows. Spinning tops are characteristic of indecision between buying and selling

In many ways, the candlestick chart is similar to the bar chart. It displays more or less the same information (high-low price range as well as closing and opening prices) but in a different format. The main difference is that on a candlestick, it is the block, or body, in the middle that shows the range between the opening price and the closing price (and not a dash as in the bar chart) and its color indicates the direction of the market for that particular period of time.These types of candlesticks are called “Japanese” candlesticks because they originated in Japan centuries ago, where they served as a rice trading and counting technique. The technique was then discovered by a Westerner and became a big hit in the world of finance. Today candlesticks are used for almost any price representation over time: for instance, you can view the price evolution of a given share price on a candlestick stock chart.Traditionally, candlesticks bodies were either black or white (white or unfilled when the currency closed higher than it opened, and black or filled when the currency closed lower than its opening price). However, candlestick charts now exist in Technicolor! Actually, they can be either green or red: green when the closing price is higher than the opening price; and red when the closing price is lower than the opening price. As you will notice along your journey to forex trading, those two colors are not only for aesthetic purposes: using red and green candles enables the eye to spot trends and reversals much faster on the graph.Here’s what a candlestick looks like:A candlestick is made up of: a body and shadows (upper and lower). The colored section of the candlestick (red or green, black/white) is called the body and it shows the open/close range. The vertical lines above and below the body are called the shadows and they show the high and low/range.If the price closes above the opening price, the body is usually colored in green (or white in a traditional candlestick chart). If the price closes underneath the opening price, the body is usually colored in red (or black).Also, long bodies are a sign of intense buying and selling activity. They are many types of candlesticks that vary according to market conditions. One of them is called “spinning tops.” This describes small bodies with long upper and lower shadows. Spinning tops are characteristic of indecision between buying and sellingThursday, September 3, 2009

Forex Charts: The Candlestick Chart 1

In many ways, the candlestick chart is similar to the bar chart. It displays more or less the same information (high-low price range as well as closing and opening prices) but in a different format. The main difference is that on a candlestick, it is the block, or body, in the middle that shows the range between the opening price and the closing price (and not a dash as in the bar chart) and its color indicates the direction of the market for that particular period of time.These types of candlesticks are called “Japanese” candlesticks because they originated in Japan centuries ago, where they served as a rice trading and counting technique. The technique was then discovered by a Westerner and became a big hit in the world of finance. Today candlesticks are used for almost any price representation over time: for instance, you can view the price evolution of a given share price on a candlestick stock chart.Traditionally, candlesticks bodies were either black or white (white or unfilled when the currency closed higher than it opened, and black or filled when the currency closed lower than its opening price). However, candlestick charts now exist in Technicolor! Actually, they can be either green or red: green when the closing price is higher than the opening price; and red when the closing price is lower than the opening price. As you will notice along your journey to forex trading, those two colors are not only for aesthetic purposes: using red and green candles enables the eye to spot trends and reversals much faster on the graph.Here’s what a candlestick looks like:A candlestick is made up of: a body and shadows (upper and lower). The colored section of the candlestick (red or green, black/white) is called the body and it shows the open/close range. The vertical lines above and below the body are called the shadows and they show the high and low/range.If the price closes above the opening price, the body is usually colored in green (or white in a traditional candlestick chart). If the price closes underneath the opening price, the body is usually colored in red (or black).Also, long bodies are a sign of intense buying and selling activity. They are many types of candlesticks that vary according to market conditions. One of them is called “spinning tops.” This describes small bodies with long upper and lower shadows. Spinning tops are characteristic of indecision between buying and selling

In many ways, the candlestick chart is similar to the bar chart. It displays more or less the same information (high-low price range as well as closing and opening prices) but in a different format. The main difference is that on a candlestick, it is the block, or body, in the middle that shows the range between the opening price and the closing price (and not a dash as in the bar chart) and its color indicates the direction of the market for that particular period of time.These types of candlesticks are called “Japanese” candlesticks because they originated in Japan centuries ago, where they served as a rice trading and counting technique. The technique was then discovered by a Westerner and became a big hit in the world of finance. Today candlesticks are used for almost any price representation over time: for instance, you can view the price evolution of a given share price on a candlestick stock chart.Traditionally, candlesticks bodies were either black or white (white or unfilled when the currency closed higher than it opened, and black or filled when the currency closed lower than its opening price). However, candlestick charts now exist in Technicolor! Actually, they can be either green or red: green when the closing price is higher than the opening price; and red when the closing price is lower than the opening price. As you will notice along your journey to forex trading, those two colors are not only for aesthetic purposes: using red and green candles enables the eye to spot trends and reversals much faster on the graph.Here’s what a candlestick looks like:A candlestick is made up of: a body and shadows (upper and lower). The colored section of the candlestick (red or green, black/white) is called the body and it shows the open/close range. The vertical lines above and below the body are called the shadows and they show the high and low/range.If the price closes above the opening price, the body is usually colored in green (or white in a traditional candlestick chart). If the price closes underneath the opening price, the body is usually colored in red (or black).Also, long bodies are a sign of intense buying and selling activity. They are many types of candlesticks that vary according to market conditions. One of them is called “spinning tops.” This describes small bodies with long upper and lower shadows. Spinning tops are characteristic of indecision between buying and selling

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment