Thursday, September 3, 2009

GTL ONLINE MOBILE TRADING

GTL ONLINE MOBILE TRADER program is comparable with full-function trading terminal. You have full access to financial markets and trading from anywhere in the world. Moreover, technical analysis and graphical visualization of financial instruments are available (including off-line mode - without connecting to server). Trading is done with adherence to confidentiality and is absolutely safe. If required, you can always refer to the trade history.

Forex Education

FX Instructor, LLC is a US-based forex education company specializing in world class forex education based on the MetaTrader 4 platform, in our real-time Live Trading Room.See our charts, hear our voice, and ask questions while the market movesObserve us analyzing the market, opening positions, and managing tradesLearn "best practices" for trading through our own exampleAcquire powerful new strategies and skillsLearn to approach the market with discipline and patienceTrade together with a global community of fellow tradersAccess a vast library of lessons, videos, and tutorials*FX Instructor is the recommended trading school for all traders of FXOpen.*Attending the Live Trading Room is beneficial for traders of all levels, no matter how big your account or experience - and it costs just $24.95 a month, with a 100% Satisfaction Guarantee.This is quite possibly the best investment ever made by traders who becomes a member of our Live Trading Room community. To take advantage of the Live Trading Room,

online forex gold investment

Successful Investments After The 2008 CrashFrom an investor point of view, we are definitely living very exciting moments and the next few years will produce huge investment and speculative opportunities if you are ready with the right mindset. Let me explain how I see events developing. Even thought I am not bullish yet, I believe we have seen a bottom in the Dow (7.882 October the 10th 2008) and, even if this level is tested again, I do not think it will go much further down.Regardless if you are bullish or bearish, one thing is sure, the markets will maintain a high level of volatility during the next few weeks or even months. So, be ready for it and make it work for you

Successful Investments After The 2008 CrashFrom an investor point of view, we are definitely living very exciting moments and the next few years will produce huge investment and speculative opportunities if you are ready with the right mindset. Let me explain how I see events developing. Even thought I am not bullish yet, I believe we have seen a bottom in the Dow (7.882 October the 10th 2008) and, even if this level is tested again, I do not think it will go much further down.Regardless if you are bullish or bearish, one thing is sure, the markets will maintain a high level of volatility during the next few weeks or even months. So, be ready for it and make it work for youSECP revises fee structure for online submission of documents

ISLAMABAD: The Securities and Exchange Commission of Pakistan (SECP) on Tuesday introduced amendments in the 6th Schedule to the Companies Ordinance, 1984 to facilitate the online submission of documents by companies to Company Registration Offices of the SECP.The fees for online services have been set lower as compared to manual submission. Registration fee for a company having share capital of less than Rs 100,000 was just Rs 2,500 for online submission (the same as prescribed earlier), while it has been raised to Rs 5,000 for manual submission. This has been done due to the reason that manual submission was expensive, time consuming, involves paperwork, resources, etc. The same was also creating delays and difficulties such as data reliability. A fee of Rs 200 for filing of returns was introduced in 1993. This fee had now been enhanced to Rs 500 in case of online filing and Rs 1000 in physical filing. This raise in filing fee was quite nominal and considered necessary to cover the escalating administrative costs. Normally, companies file two returns per annum and annual cost comes to Rs 1000 in case of online submission and Rs 2000 in case of manual submission. Online service had expedited the processes, making them easier and cost effective. It saves time as well as resources, increases efficiency, and creates a paperless and hassle free environment. Those who need to file returns as well as register companies could do so from the comfort of their offices without the need to visit the SECP offices.

Forex Charts: The Candlestick Chart 2

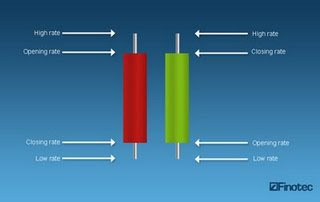

Here’s what a candlestick chart looks like:Above is a candlestick stock chart showing the activity of the MSFT share over the past three months.Seeing the price activity (highs, lows, opening and closing prices) over a given period of time allows traders to identify patterns and trends. Bar charts are also known as bar graphs.

Here’s what a candlestick chart looks like:Above is a candlestick stock chart showing the activity of the MSFT share over the past three months.Seeing the price activity (highs, lows, opening and closing prices) over a given period of time allows traders to identify patterns and trends. Bar charts are also known as bar graphs.Forex Charts: The Candlestick Chart 1

In many ways, the candlestick chart is similar to the bar chart. It displays more or less the same information (high-low price range as well as closing and opening prices) but in a different format. The main difference is that on a candlestick, it is the block, or body, in the middle that shows the range between the opening price and the closing price (and not a dash as in the bar chart) and its color indicates the direction of the market for that particular period of time.These types of candlesticks are called “Japanese” candlesticks because they originated in Japan centuries ago, where they served as a rice trading and counting technique. The technique was then discovered by a Westerner and became a big hit in the world of finance. Today candlesticks are used for almost any price representation over time: for instance, you can view the price evolution of a given share price on a candlestick stock chart.Traditionally, candlesticks bodies were either black or white (white or unfilled when the currency closed higher than it opened, and black or filled when the currency closed lower than its opening price). However, candlestick charts now exist in Technicolor! Actually, they can be either green or red: green when the closing price is higher than the opening price; and red when the closing price is lower than the opening price. As you will notice along your journey to forex trading, those two colors are not only for aesthetic purposes: using red and green candles enables the eye to spot trends and reversals much faster on the graph.Here’s what a candlestick looks like:A candlestick is made up of: a body and shadows (upper and lower). The colored section of the candlestick (red or green, black/white) is called the body and it shows the open/close range. The vertical lines above and below the body are called the shadows and they show the high and low/range.If the price closes above the opening price, the body is usually colored in green (or white in a traditional candlestick chart). If the price closes underneath the opening price, the body is usually colored in red (or black).Also, long bodies are a sign of intense buying and selling activity. They are many types of candlesticks that vary according to market conditions. One of them is called “spinning tops.” This describes small bodies with long upper and lower shadows. Spinning tops are characteristic of indecision between buying and selling

In many ways, the candlestick chart is similar to the bar chart. It displays more or less the same information (high-low price range as well as closing and opening prices) but in a different format. The main difference is that on a candlestick, it is the block, or body, in the middle that shows the range between the opening price and the closing price (and not a dash as in the bar chart) and its color indicates the direction of the market for that particular period of time.These types of candlesticks are called “Japanese” candlesticks because they originated in Japan centuries ago, where they served as a rice trading and counting technique. The technique was then discovered by a Westerner and became a big hit in the world of finance. Today candlesticks are used for almost any price representation over time: for instance, you can view the price evolution of a given share price on a candlestick stock chart.Traditionally, candlesticks bodies were either black or white (white or unfilled when the currency closed higher than it opened, and black or filled when the currency closed lower than its opening price). However, candlestick charts now exist in Technicolor! Actually, they can be either green or red: green when the closing price is higher than the opening price; and red when the closing price is lower than the opening price. As you will notice along your journey to forex trading, those two colors are not only for aesthetic purposes: using red and green candles enables the eye to spot trends and reversals much faster on the graph.Here’s what a candlestick looks like:A candlestick is made up of: a body and shadows (upper and lower). The colored section of the candlestick (red or green, black/white) is called the body and it shows the open/close range. The vertical lines above and below the body are called the shadows and they show the high and low/range.If the price closes above the opening price, the body is usually colored in green (or white in a traditional candlestick chart). If the price closes underneath the opening price, the body is usually colored in red (or black).Also, long bodies are a sign of intense buying and selling activity. They are many types of candlesticks that vary according to market conditions. One of them is called “spinning tops.” This describes small bodies with long upper and lower shadows. Spinning tops are characteristic of indecision between buying and sellingForex Charts: The Bar Chart 2

Here’s what a bar chart looks like. In the example below of EUR/USD, a bar represents one day of trading, the uptrend is displayed in green, and the downtrend is displayed in red.Seeing the price activity (highs, lows, opening and closing prices) over a given period of time allows traders to identify patterns and trends. Generally speaking, bar charts are also known as bar graphs. On the Finotec Trading Platform, you can choose the bar width and you can also choose different colors for uptrends and downtrends. You can also choose a different type of chart. And of course, you can add indicators very easily by clicking the “add indicator” button.

Here’s what a bar chart looks like. In the example below of EUR/USD, a bar represents one day of trading, the uptrend is displayed in green, and the downtrend is displayed in red.Seeing the price activity (highs, lows, opening and closing prices) over a given period of time allows traders to identify patterns and trends. Generally speaking, bar charts are also known as bar graphs. On the Finotec Trading Platform, you can choose the bar width and you can also choose different colors for uptrends and downtrends. You can also choose a different type of chart. And of course, you can add indicators very easily by clicking the “add indicator” button.Forex Charts: The Bar Chart 1

Bar charts are among the most popular types of charts used in technical analysis. Like a line chart, a bar chart shows the closing price of a currency, but it also shows additional information: the opening price as well as the highest and the lowest prices reached during the day/week/hour. Since the bar refers to a segment of time, you ought to know what exact frame of time it covers before you start analyzing any bar chart.Since bars also display the Open, the High, the Low and the Close price for a given currency, they are also referred to as “OHLC” charts. Here is what a bar looks like:The top of the bar shows the highest traded price for a given currency and a given time period. The bottom shows the lowest traded price for that same currency and during that same time period. As a whole, the vertical bar thus shows the currency’s trading range for the given time period.The horizontal dash on the left of the bar indicates the opening price while the one on the right side indicates the closing price.

Bar charts are among the most popular types of charts used in technical analysis. Like a line chart, a bar chart shows the closing price of a currency, but it also shows additional information: the opening price as well as the highest and the lowest prices reached during the day/week/hour. Since the bar refers to a segment of time, you ought to know what exact frame of time it covers before you start analyzing any bar chart.Since bars also display the Open, the High, the Low and the Close price for a given currency, they are also referred to as “OHLC” charts. Here is what a bar looks like:The top of the bar shows the highest traded price for a given currency and a given time period. The bottom shows the lowest traded price for that same currency and during that same time period. As a whole, the vertical bar thus shows the currency’s trading range for the given time period.The horizontal dash on the left of the bar indicates the opening price while the one on the right side indicates the closing price.What Is Margin Trading?

In the world of forex, margin trading (or “buying on margin”, or “trading on margin”) means trading with short-term borrowed capital. Margin is thus a form of borrowed money or debt. This borrowed capital is used to buy much more currency that you’d be able to purchase ordinarily (unless you have hundreds of thousands of dollars available). In the forex market, currencies are usually traded in lots, with a standard lot being $100,000. (The forex market is a highly leveraged market.) The term “lot” refers to the minimum amount of currency that must be bought. To achieve this amount of currency, brokers offer a margin trading option. This means that through your margin account, you can execute deals with a small amount of initial capital. You can open $100,000 or $10,000 positions with as little as $50 or $1,000. In forex, trading small amounts makes no sense since profits can only be made through large amounts of currency.Let’s take an example of margin trading: Some market indicators are telling you that the Euro will strengthen against the US Dollar. You believe it’s the right time to buy EUR/USD and you open a position of $100,000 (one lot) to buy Euros with a 1% margin at the price of 1.3520 hoping that the rate will rise. This means that you are holding $100,000 worth of Euros with an initial deposit of $1,000. The price does rise and reaches 1.3570 You decide to sell and close your position. You have won about $500 (50 pips x $10 per pip), which constitutes a 50% return on your initial capital investment of $1,000. You know have $1,500 in your account. Also, brokers use this forex margin as collateral to cover any losses incurred by the trader. Since in margin trading, nothing is actually sold or bought for delivery, the funds in your account serve as margin requirements. Those margin requirements vary depending on which brokerage firm you choose. To match its traders’ risk levels, Finotec offers low margin requirements – as low as 0.5%. However, we advise traders new in the forex industry to start trading with higher forex margin capacities to minimize the amount of risk involved in such transactions.

What Is a Margin Call

As you know, forex is a speculative activity, through which you can either win or lose money. When the market moves against your position, there is a risk that the capital in your account will fall below margin requirements. In this case, the broker will issue a margin call for you to add funds. If you fail to do so, your position(s) will be closed to prevent further losses. A margin call thus prevents you from having a negative balance in your account. Example :A trader opens a $10,000 trading account. He then opens one lot of the GBP/USD with a margin requirement of $1,000 (used margin). This means that he now has a $9,000 usable margin. The used margin refers to the capital available for potential losses or for the purchase of new positions.In the event that the market moves against your position and that your losses exceed the $9,000 of your usable margin, if you do not add funds upon receiving a margin call, your position will be closed. By closing your position, your broker limits both his and your risk. The consequence is that when trading forex online, you will never lose more than what you’ve deposited in your account.

Forex Charts

When approaching the forex to trade, there are two ways you may analyze the forex market: using fundamental analysis or technical analysis. Although some analysts would argue that one is better than the other, finding a middle-ground between both approaches is usually the common recommendation.In brief, whereas fundamental analysis deals with economic, political and social developments and their impact on the supply and demand forces, technical analysis deals with price movements. Forex charts are generally associated with technical analysis. Basically, once you enter the world of forex technical analysis, you also enter the world of online forex charts. Since technical analysis focuses on the study of price movement (current, past and future), it uses all sort of graphs and forex chart indicators. Viewing those different types of forex charts will help you identify forex trends according to which you will make your trading decisions.When looking at such a chart, you are viewing historical price actions which in some way will give you an idea of where the price is heading to. Here, you are looking at a candlestick chart.There are three common types of Forex charts:Line Chart: a very basic chart. A line chart is made up of contiguous lines connecting one previous closing price to the next. Bar Chart: Like the line chart, the bar chart shows the closing price of a given currency, but it also shows its opening price and it's high and low. Candlestick Chart: probably the most popular type of charts. On top of showing you the closing, opening, high and low prices, it gives you an indication about the strength of the buying and selling forces. To read those charts beyond the obvious, traders have at their disposal a wide range of trend indicators to help them identify good trading opportunities as well as good entry and exit points. You can apply indicators to each type of forex charts. However, interpreting those forex charts requires precise knowledge of the chart indicators you choose to use and although it may seem easy, identifying forex trends can be quite difficult. Each type of chart will give you more or less the same information but in a different form.

What is a Forex Broker?

Forex Broker definitionA Forex Broker (or forex brokerage firm) is a company, institution - or an individual – acting as an intermediary between currency buyers and currency sellers. Usually though, forex brokers serve as the “transaction counterpart.” Recent Internet technologies and online dealing have made it easier for new forex brokers to see the light of day and new firms are sprouting up all over the web. So what is it that makes a good Forex Broker? And what is it that makes Finotec a great Forex Broker?Forex Brokers can be gauged according to four main criteria:Reliability. This is achieved by becoming a main industry player both through years of experience during which the firm gains recognition among the world’s leading financial institutions and through the consolidation of its client base. Quality institutions are usually registered with financial authorities such as the FSA. Only a few firms have achieved this level of reliability and business, and Finotec is of course one of them. Low spreads and leverage. The spreads offered by a Forex Broker are the reflection of the solidity and stability of its financial foundation. The lower the spreads, the better-established it is with major banks and the more efforts it makes towards its clients. As for leverage, the higher it is, the less money you have to deposit. Resources and tools. The larger and more serious the firm, the more it invests in R&D. This translates into more resources, more tools, better software, and more qualified personnel. For the client, this means “all-in-one trading”: all tools and resources required to trade are easily accessible from that same broker. Support. Although this may not seem so important at first glance, it is crucial. If you have the slightest technical problem with the software or if you have any questions, the best is to always have someone available to assist you – someone qualified! So why is Finotec the best forex broker?Because it fully meets those criteria and offers much more. Although we are not of those heavyweight financial institutions that have been in place for hundreds of years, we have managed to enter the big league of forex brokers in less than a decade. This success wouldn’t have been possible without our dedication to excellence and our innovative approach to trading.Not only do we offer low spreads and high leverage, we also provide our clients with advanced trading tools and daily analysis. written by our very own team of experts. Our assistance team is always there to help you with any problem you may encounter. We are constantly working on product and service and improvement to make forex trading easier and faster for our clients. Also, as an FSA (Financial Services Authority) registered company, we are committed to transparency in all areas of operation.In the end, it is the customer that decides who is the best forex broker. The relationship we build with our clients is based on trust and a will to succeed. Once traders start trading with us, they feel they can rely on us and they know that we are here to help them achieve their investment objectives.When trading forex with Finotec, you are in the best of hands, the hands of the best forex broker!

Forex Trade Software

When you first come across the idea of automated Forex trading how did you react? Pessimistic is how most people react. Well if you were optimistic or pessimistic but curious I would like to congratulate you! The truth is Forex trading software will work for you, as it has worked for thousand other people. Those people are now enjoying extra income without doing anything. Many of them have actually quit their old job and living solely from automated Forex trading software. Why did they quit their job? Because they do not need them since trading Forex is more than enough to cover their expenses. You must be wondering how Forex trade software performs such task. Did you know that foreign currency actually behaves according to a certain pattern? Researches on these patterns have been conducted in many universities. They actually found out that while erratic, Forex movements can be predicted to a certain extent. The researches have reached a point where the predictions become so accurate therefore it is very profitable. So experts simply compile these formulas and knowledge into Forex trade software.So what you need to do to start getting your automatic income? Well glad you asked! Simply download the software, setup the software according to how you want it to work, and sit back. You can start seeing the results in few days time. The settings can vary between programs and some programs can be switched between semi automatic and fully automatic. Simply follow the instructions given for your software

Forex Day Trading

What is Forex Day Trading?With Forex trading now accessible to all investors thanks to the advent of Internet technology, forex day trading has become one of the most popular types of currency trading. Some traders – professional traders – have made forex trading their day job. They engage in what is known as forex day trading. As its name suggests, forex day trading consists in opening and closing positions – buying and selling currencies – within the same day. Usually, forex day traders try to take advantage of the fast-fluctuating currency rates, even if their movements are often smaller on a shorter term.The four major currency pairs have an average daily range of 104 pips, which represents $1,040 per lot – much more than other currency trading markets. With their longer “length of line”, they also offer more “swing trades” opportunities.Forex day trading is time-consuming and can also be money-consuming if you are not properly educated and trained in currency trading. To help you understand the ins and outs of day trading forex, Finotec offers you free fundamental and technical analysis education (see our Forex Trading Videos Section) as well as all the tools you need to analyze market trends, including a free demo account. As with stocks day trading, forex day trading can be done over the entire day, but it also can be done over a few hours, a few minutes or even a few seconds! Part of the skills of day traders lies in their ability to react quickly to the markets and make fast decisions.Different Types of Forex Day TradingAs mentioned above, some traders will enter and close positions within a few minutes – or even a few seconds (this method is known as “scalping”) – while others will maintain positions for several hours or even through the entire day. While some day traders combine these strategies or switch from one to another depending on current market conditions, most prefer to stick to one type of day trading.Forex day trading strategies can also be categorized according to the type of resources and data used by the trader. Some day traders for instance trade only on fundamental analysis. They wait for the release of certain economic indicators and data (payrolls, GDP, etc…) and trade the expected market swings. Others rely solely on technical analysis. Whichever type of trader you are, you must know always watch out for economic and statistical releases if you don’t want any surprises.A Few Tips for Day Trading ForexSkill has a big part to play in forex day trading. You should have a good understanding of the markets, their trends and their direction before you engage in this type of trading. You should also know how to read the information and use all the resources made available to you. Finotec has put together a series of forex training videos to help you do just that. Stick to your strategy. While this tip is true for almost all types of trading, it is even truer for day trading since you tend to spend more time in front of your computer and pay attention to the slightest move in either direction, which often prompts you to act and change your strategy. Whatever happens, do not panic. You should be aware that forex day trading comes with a certain degree of risk and accepting that risk means also accepting to lose sometimes. Make sure you have enough time on your hands. Most day traders are professional traders who have made a career of currency day trading. Others have jobs that allow them to devote some time to it during their workday. So make sure your schedule is suited to this type of trading. To start forex day trading with Finotec, open an account by filling out the form on the right. If you have any questions, one of our representatives will be happy to help you

Forex Trading Strategies

With stock prices tumbling almost daily, multi-billion dollar Ponzi "investment" schemes wreaking financial havoc in people's lives grabbing headlines, and decades-old companies scrambling for the shelter of government bailouts, it's not surprising that seasoned stock traders and investment novices alike are feeling quite shell shocked. Many have stepped aside from trading in the stock market and are looking for alternative ways to earn a comfortable living. Quite a few have found it in the Foreign Exchange Market, commonly known as Forex.The more astute amongst them are getting Forex training before risking even a penny of their capital.Forex is the biggest financial market in the world. Over three trillion US dollars per day are traded on the Foreign Exchange. It's an over-the-counter market that offers extreme liquidity to the people who trade it.You can trade Forex from anywhere in the world twenty-four hours a day, five and a half days a week.One of the reasons most folks who are considering trading this market need forex training is because they will be dealing with an entirely new investment language.For example, as a trader you will be trading currency in pairs – buying one while selling another. Essentially you will be speculating that one currency will either rise or fall in value against another currency.Although virtually any currency can be traded, Forex focuses primarily on the "majors". These are the British pound, the US dollar, the euro, the Japanese yen, the Canadian dollar, the Swiss franc, and the Australian dollar. All of these currencies are quoted in pairs.Since nobody has a crystal ball, Forex traders make their money by exploiting market probabilities. Traders need to have a thorough understanding of different tools, different markets, and different trading strategies along with how and when to use them. Otherwise they can very quickly lose substantial amounts of money.However with proper forex training, these same people can gain a trading edge that could earn them substantial profits.Knowledge to Action has recently launched ‘Ultimate Forex Secrets Seminar 2009’. When you attend you will also receive a ground-breaking 60-page report - "Millionaire Forex Trader Secrets" This report contains some of the key money making secrets of the Forex community!

With stock prices tumbling almost daily, multi-billion dollar Ponzi "investment" schemes wreaking financial havoc in people's lives grabbing headlines, and decades-old companies scrambling for the shelter of government bailouts, it's not surprising that seasoned stock traders and investment novices alike are feeling quite shell shocked. Many have stepped aside from trading in the stock market and are looking for alternative ways to earn a comfortable living. Quite a few have found it in the Foreign Exchange Market, commonly known as Forex.The more astute amongst them are getting Forex training before risking even a penny of their capital.Forex is the biggest financial market in the world. Over three trillion US dollars per day are traded on the Foreign Exchange. It's an over-the-counter market that offers extreme liquidity to the people who trade it.You can trade Forex from anywhere in the world twenty-four hours a day, five and a half days a week.One of the reasons most folks who are considering trading this market need forex training is because they will be dealing with an entirely new investment language.For example, as a trader you will be trading currency in pairs – buying one while selling another. Essentially you will be speculating that one currency will either rise or fall in value against another currency.Although virtually any currency can be traded, Forex focuses primarily on the "majors". These are the British pound, the US dollar, the euro, the Japanese yen, the Canadian dollar, the Swiss franc, and the Australian dollar. All of these currencies are quoted in pairs.Since nobody has a crystal ball, Forex traders make their money by exploiting market probabilities. Traders need to have a thorough understanding of different tools, different markets, and different trading strategies along with how and when to use them. Otherwise they can very quickly lose substantial amounts of money.However with proper forex training, these same people can gain a trading edge that could earn them substantial profits.Knowledge to Action has recently launched ‘Ultimate Forex Secrets Seminar 2009’. When you attend you will also receive a ground-breaking 60-page report - "Millionaire Forex Trader Secrets" This report contains some of the key money making secrets of the Forex community!Critical Mistakes in Forex Trading

An average person has a very simple life, because of this they are blissfully unaware of exactly what the problems are that they can encounter. Knowing what the potential disasters are before you get started can help you to ensure you do not find yourself in the same situation. Remember, there is nothing wrong with learning from the mistakes of others and a bit of effort carefully placed into the proper research will allow you to reduce your expenses, save hassle and make money much faster.The very first mistake that is made is not entering a stop loss order. This is a useful tool that will allow you to quickly and easily set a minimum to the currency that you hold. Once it drops to a certain level it would be arranged to automatically sell. The benefit of this is you do not even have to watch the market directly to have your currency sell at the level that you desire. This is quite useful in the event that you are not interested in taking a loss on your transactions. Because of the turbulence that the market gives, it is very dangerous to not have a stop loss order in at almost all times.Allowing yourself to become wrapped up in emotion as well will cost you thousands of dollars in the forex market. Knowing that you have some problems with emotion will allow you to learn how to distance yourself while still getting all of the benefits that you need. If you start to think that you are never going to have any problems with disasters striking you will quickly discover just how hard it can be to make things work out properly. Taking some time to practice separating yourself from the situation is extremely important. Another critical mistake that is often made is trying to predict what the market is going to do. This can create some serious problems because it can often lead to overconfidence. You absolutely have to stick to just facts rather than trying to just guess or predict what the market will do. If you decide to try guessing you might luck out and make a correct guess or two, but the majority of the times you attempt at just guessing you are going to lose money. Avoid this situation if at all possible and instead focus on getting all of the information you can possibly gather together to avoid making an incorrect decision.One other mistake that is often made is treating investing as if it is a hobby. This creates a lot of problems for people when they are trying to work on straightening out details. Making money at forex is possible, but only if you treat it like an actual business. In order to be truly successful you need a business mindset and you need to be thinking clearly when you are working on all of the transactions. If you have no clue what you are doing, you will quickly discover that the entire process is useless and provides you no major benefits. In order to really enjoy the process, you absolutely must take the time to determine your goals and a course of action. Diving right in and getting started working is not a safe idea, not is it a wise investment of your money.The right mindset is one of the biggest things that is required in order to be secure while engaging in transactions in foreign exchange. Knowing what the major problems tend to be and working diligently to avoid them will help you to ensure you get on track properly and stay there. Taking control of your forex experience really is possible but you absolutely must ensure you get started successfully. Starting out properly is much easier than trying to fix your mistakes after the fact. Success is possible, but avoiding these mistakes will help further ensure all of your success.

Overview of the Forex Market

The speaker provides an overview of the forex market. He suggests that the forex market carries the most amount of liquidity in relation to any other type of securities market. Not only is there tremendous liquidity, there is also trading available 24 hours per day; however, this can be a negative if you cannot pull yourself away from the screen. He also talks through the leverage that is taken in the forex market. Typically, traders will use 200:1 leverage when placing trades. New traders should be extremely careful as their accounts can be wiped out on 1 trade if proper risk management is not employed. Another benefit of the forex market is that it only moves dramatically when macroeconomic events take place, as opposed to a stock which can have a huge drop overnight due to earnings releases or other negative news

The speaker provides an overview of the forex market. He suggests that the forex market carries the most amount of liquidity in relation to any other type of securities market. Not only is there tremendous liquidity, there is also trading available 24 hours per day; however, this can be a negative if you cannot pull yourself away from the screen. He also talks through the leverage that is taken in the forex market. Typically, traders will use 200:1 leverage when placing trades. New traders should be extremely careful as their accounts can be wiped out on 1 trade if proper risk management is not employed. Another benefit of the forex market is that it only moves dramatically when macroeconomic events take place, as opposed to a stock which can have a huge drop overnight due to earnings releases or other negative newsChoosing The Right Expert Advisors

Forex Expert Advisors For Beginners

Forex Expert Advisors level the arena for individuals who want to get into Forex trading. Banks and institutional investors are far ahead from individual Forex traders when it comes to expertise in trading skills. But with the help of the EAs, it seems that the gap between the expertise and the experience has narrowed.

Forex Expert Advisors level the arena for individuals who want to get into Forex trading. Banks and institutional investors are far ahead from individual Forex traders when it comes to expertise in trading skills. But with the help of the EAs, it seems that the gap between the expertise and the experience has narrowed.Forex Trading Styles

There are two main Forex trading styles that are used by a majority of Forex traders:Technical TradingFundamental TradingEach of these has its differences, so let’s look into them in some more detail.Technical Forex trading is primarily based on one of two tools. Charting tools are, as the name suggests, charts of past currency movements. As with any chart, you can add in trend lines to help smooth out the minor fluctuations and allow you to see the bigger picture. Of course, charting is a lot more complicated than mere trend lines but there are software programs out there that will help with your chart analysis. Once you get deeper into charts, the other main technical Forex trading method is the use of Quantitative Trading Models. These use math to analyze the markets and identify opportunites for trading. Technical trading uses past data to endeavor to predict future movements in the market.Fundamental Forex trading involves the analysis of things such as key economic data. This includes reports from governments, current event news coverage and any other data that the fundamental analyst considers useful. Fundamentalists consider that currency movements are mainly affected by economic and political conditions and events. Whilst central banks have been known to get involved in the currency markets, this has become less common in recent years. Fundamentalist Forex trading looks at interest rates, inflation figures, balance of trade figures, Gross Domestic Product, retail price indexes, producer price indexes amongst other factors.You need to decide which of these two trading styles fits best with your own personal style as well as the amount of time you have available for analysis and any help that you can get from computer programs.Forexyard is the leader in online currency trading. It provides real-time deal execution, free Forex charts and quotes together with 24 hour commission free Forex trading.

Foreign Exchange Tips

Setting goals is a great way to become successful. By setting a goal you work hard to achieve that goal. Many people set small goals so when they reach it they feel a sense of achievement and set a bigger goal. People who are in the financial market also set goals for themselves. These goals will be different from different marketers because they all have different income levels and circumstances. It is hard to find the right market that fits you meaning the right market that fits your goals (no matter how big or small) and your circumstances too. In this article I will give you a market that is very profitable and the market I am talking about is Forex (otherwise known as the Foreign Exchange Market). One thing that you should note about this market is that it isn’t using stock or shares but instead it is using a nation currency for economic trading. The reason for this is that a nation’s currency can’t be reduced by certain incidents like news or weather, whereas shares are affected by these factors and can end up being reduced in a day! As you should be able to tell this way of trading is a good idea for marketers.A question you should ask yourself before jumping into the Forex market is whether you are planning to trade as a business or an avocation. In other words are you planning to work part time which would mean you will be doing this in your free time or are you planning to work full time. It doesn’t matter which one you choose because the Forex market is open for a very long period (24 hours and 6 six days a week). Online trading platforms facilitate the needs of the other nation’s time zones.The question of part time and full time is very important because if you are going to trade on the Forex market part time then you will not have the same capital as someone trading full time. Regardless of your choice, you should know that the Forex market can accommodate any trading plans.With two unit sizes this is easy to do. The Forex Market contains a full unit size which is 100,000 units which has a 1% unit margin and the other unit size is 10,000 units which are controlled by a smaller unit margin of 0.5%. A mini account can be started for as little as $300 which is not bad considering all the profit that can be made back from this system.Now that you know what the Forex market is, does it fit your financial goal and circumstances? If you are looking for a financial market then why not use Forex? It is very easy to use and with the cheap set up of $300 (cheaper than many competitors) that can be turned into $3,000 it is very hard to let this offer pass you.

Setting goals is a great way to become successful. By setting a goal you work hard to achieve that goal. Many people set small goals so when they reach it they feel a sense of achievement and set a bigger goal. People who are in the financial market also set goals for themselves. These goals will be different from different marketers because they all have different income levels and circumstances. It is hard to find the right market that fits you meaning the right market that fits your goals (no matter how big or small) and your circumstances too. In this article I will give you a market that is very profitable and the market I am talking about is Forex (otherwise known as the Foreign Exchange Market). One thing that you should note about this market is that it isn’t using stock or shares but instead it is using a nation currency for economic trading. The reason for this is that a nation’s currency can’t be reduced by certain incidents like news or weather, whereas shares are affected by these factors and can end up being reduced in a day! As you should be able to tell this way of trading is a good idea for marketers.A question you should ask yourself before jumping into the Forex market is whether you are planning to trade as a business or an avocation. In other words are you planning to work part time which would mean you will be doing this in your free time or are you planning to work full time. It doesn’t matter which one you choose because the Forex market is open for a very long period (24 hours and 6 six days a week). Online trading platforms facilitate the needs of the other nation’s time zones.The question of part time and full time is very important because if you are going to trade on the Forex market part time then you will not have the same capital as someone trading full time. Regardless of your choice, you should know that the Forex market can accommodate any trading plans.With two unit sizes this is easy to do. The Forex Market contains a full unit size which is 100,000 units which has a 1% unit margin and the other unit size is 10,000 units which are controlled by a smaller unit margin of 0.5%. A mini account can be started for as little as $300 which is not bad considering all the profit that can be made back from this system.Now that you know what the Forex market is, does it fit your financial goal and circumstances? If you are looking for a financial market then why not use Forex? It is very easy to use and with the cheap set up of $300 (cheaper than many competitors) that can be turned into $3,000 it is very hard to let this offer pass you.Risks in Forex Trading

As a mostly speculative activity, forex trading involves many risks. In two words, forex trading risks are mainly about losing money. That's why Forex Money Management is so crucial when it comes to forex. Traders must have a plan and stick to it no matter what, or else they might lose their shirt in a matter of hours – that’s why you must never trade money that you need to survive. In fact, one of the ways to approach forex trading is through risk management. Much of how you trade is actually defined by your risk profile: are you someone who likes taking risks, hates taking risks or someone who is generally apathetic to risk?Depending on your answer to this question, you will build your own customized trading strategy. Having a trading plan and sticking to it is the only way to make forex trading profitable and to avoid the main forex trading risks. When trading forex, risk management makes up a big part of your plan. To define a clear trading plan, traders must define several points:When to trade: what timeframes are best suited to your trading routine? Are you more of a day-trader – someone who trades over a couple of days, usually aiming for 10 to 50 pip profits; an intra-day trader – this category of traders is also known as “scalpers”: they trade on time frames of a few minutes and make a large number of deals for profits usually ranging from 5 to 10 pips; a swing trader – these are professional traders who open positions over several days for profits ranging from 50 to 100 pips; or a position trader – meaning that you make less transactions over a longer period of time for profits ranging from 500 to 1000 pips To learn more, continue to: Forex Trading HoursWhat tools do you base your trading strategy on? Whereas intra-day traders and day traders will generally make their trading decisions according to technical analysis, position traders usually trade according to fundamental analysis. As for swing traders, they usually use both. Which products do you trade? Some products such as options are more complex than others and will therefore be traded by more seasoned traders. Choosing the right product is also essential when it comes to trading strategy. And last but not least: what risk are you willing to take? According to your money management system, you will define a certain percentage of your capital you are ready to loose, and set margin, leverage and stop-losses accordingly. The extent of forex trading risks is equal to its potential profitability. Indeed, since forex is a leveraged market, it allows for huge profits but can also lead to huge losses. That’s why we recommend traders new to the field to use a relatively low leverage level at the beginning. That way, you can test your overall strategy without risking too much. If you lose, you can readjust your strategy and still have enough money to get back into the game.In brief, the main forex trading risk is losing money. However, with a sound trading strategy, solid money and risk management plan and a cool head, you may limit and minimize your losses while maximizing your profits. It is also to be noted that with Finotec, in order to prevent over-ambitious traders to lose what they can’t afford, you cannot lose more than your initial deposit. If a trader reaches that point, part or all of his positions will be closed to avoid.

Benefits Of Forex Trading

Forex offers great investment opportunities for those wishing to diversify their portfolio. Forex benefits and advantages are many. Here are some of the main reasons why more and more corporate and individual investors choose to trade forex:No Commissions, Small Transaction Costs: This is probably one of the most attractive forex benefits. Indeed, when you trade forex, you are not charged any fees or commissions on your deals. The way it works is that brokerage firms get paid through spreads (the difference between the bid and the ask price). This allows for extremely low transaction costs. Thanks to its large number of clients and to the large volume and capital traded through the platform, Finotec offers very competitive spreads on the main currency pairs. Leverage Trading: High Returns with Relatively Small Deposits. this means that even if traders deposit a small amount of money, they can actually trade with a much bigger contract value. Finotec offers a 200 to 1 leverage. If you make a $100 margin deposit, you can actually trade $20,000 worth of currencies. With a $1,000 margin deposit, you can buy or sell $200,000 worth of currencies. However, you must keep in mind that if leverage allows for substantial profits, it also can lead to equally significant loss. One of the chief forex benefits can thus become a major liability. That's why you need to figure out your own risk management policy before you start trading. High Liquidity: This refers to the forex market's ability to quickly convert or liquidate deals through buying or selling and without causing a significant price movement. The high liquidity of the forex market is mainly due to the large volume of currencies traded around the world. That way, currencies are exchanged instantaneously, 24 hours a day and with minimum loss value, since the next trade is usually executed at the same price as the last one. In the forex market, there are always plenty of ready and willing buyers and sellers. Open 24 hours a day: The forex market is open 'round the clock, 5 days a week, from Sunday 5 pm EST to Friday afternoon 4 pm EST. This is due to the fact that there is an overlap of different time zones and that there is no physical central exchange that opens and closes at a particular time. Forex works through a global electronic network of corporations, banks and individuals. When you hear that a certain rate closed at particular price, this refers to the price at market close in London or elsewhere. However, unlike securities, currencies are still traded somewhere else in the world. The global scope of currency trading, as well as the high demand for currency, implies that there are always investors somewhere who are willing to buy or sell currencies. This also allows traders to trade on a part-time basis, meaning that they can choose to trade whenever they want. Learn more about Forex Trading Hours Trade with as Little as $200: This is one of the main forex benefits when it comes to Forex Trading. Most brokers nowadays give their clients the possibility to open accounts with only a few hundreds of dollars (this is not a lot, considering the exponential profits you can make on a few hundred dollars). With Finotec, you can open a Mini Account with as little as $200. You can also open a Standard Account with $10,000 or practice on a demo account for free! Out with old investment schemes, in with new! As you see, you don't need to be a big shot to enter the world of forex and make substantial profit! With Finotec, whatever the size of your account, you are guaranteed personal and professional service that's second-to-none and excellent trading conditions.

Forex Market History

This article is an overview into the historical evolution of the foreign exchange market. It follows the historical roots of the international currency trading from the days of the gold exchange, through the Bretton Woods Agreement, to its current setting.The Gold exchange period and the Bretton Woods Agreement.The Bretton Woods Agreement, established in 1944, fixed national currencies against the dollar, and set the dollar at a rate of 35USD per ounce of gold. In 1967, a Chicago bank refused to make a loan in pound sterling to a college professor by the name of Milton Friedman because he had intended to use the funds to short the British currency. The bank's refusal to grant the loan was due to the Bretton Woods Agreement.This agreement aimed at establishing international monetary steadiness by preventing money from taking flight across countries, and curbing speculation in the international currencies. Prior to Bretton Woods, the gold exchange standard - dominant between 1876 and World War I - ruled over the international economic system. Under the gold exchange, currencies experienced a new era of stability because they were supported by the price of gold.However, the gold exchange standard had a weakness of boom-bust patterns. As an economy strengthened, it would import a great deal until it ran down its gold reserves required to support its currency. As a result, the money supply would diminish, interest rates escalate and economic activity slowed to the point of recession. Ultimately, prices of commodities would hit bottom, appearing attractive to other nations, who would sprint into a buying fury that injected the economy with gold until it increased its money supply, driving down interest rates and restoring wealth into the economy. Such boom-bust patterns abounded throughout the gold standard until World War I temporarily discontinued trade flows and the free movement of gold.The Bretton Woods Agreement was founded after World War II, in order to stabilize and regulate the international Forex market. Participating countries agreed to try to maintain the value of their currency within a narrow margin against the dollar and an equivalent rate of gold as needed. The dollar gained a premium position as a reference currency, reflecting the shift in global economic dominance from Europe to the USA. Countries were prohibited from devaluing their currencies to benefit their foreign trade and were only allowed to devalue their currencies by less than 10%. The great volume of international Forex trade led to massive movements of capital, which were generated by post-war construction during the 1950s, and this movement destabilized the foreign exchange rates established in the Bretton Woods Agreement.1971 heralded the abandonment of the Bretton Woods in that the US dollar would no longer be exchangeable into gold. By 1973, the forces of supply and demand controlled major industrialized nations' currencies, which now floated more freely across nations. Prices were floated daily, with volumes, speed and price volatility all increasing throughout the 1970s, and new financial instruments, market deregulation and trade liberalization emerged.The onset of computers and technology in the 1980s accelerated the pace of extending the market continuum for cross-border capital movements through Asian, European and American time zones. Transactions in foreign exchange increased intensively from nearly $70 billion a day in the 1980s, to more than $1.5 trillion a day two decades later.

This article is an overview into the historical evolution of the foreign exchange market. It follows the historical roots of the international currency trading from the days of the gold exchange, through the Bretton Woods Agreement, to its current setting.The Gold exchange period and the Bretton Woods Agreement.The Bretton Woods Agreement, established in 1944, fixed national currencies against the dollar, and set the dollar at a rate of 35USD per ounce of gold. In 1967, a Chicago bank refused to make a loan in pound sterling to a college professor by the name of Milton Friedman because he had intended to use the funds to short the British currency. The bank's refusal to grant the loan was due to the Bretton Woods Agreement.This agreement aimed at establishing international monetary steadiness by preventing money from taking flight across countries, and curbing speculation in the international currencies. Prior to Bretton Woods, the gold exchange standard - dominant between 1876 and World War I - ruled over the international economic system. Under the gold exchange, currencies experienced a new era of stability because they were supported by the price of gold.However, the gold exchange standard had a weakness of boom-bust patterns. As an economy strengthened, it would import a great deal until it ran down its gold reserves required to support its currency. As a result, the money supply would diminish, interest rates escalate and economic activity slowed to the point of recession. Ultimately, prices of commodities would hit bottom, appearing attractive to other nations, who would sprint into a buying fury that injected the economy with gold until it increased its money supply, driving down interest rates and restoring wealth into the economy. Such boom-bust patterns abounded throughout the gold standard until World War I temporarily discontinued trade flows and the free movement of gold.The Bretton Woods Agreement was founded after World War II, in order to stabilize and regulate the international Forex market. Participating countries agreed to try to maintain the value of their currency within a narrow margin against the dollar and an equivalent rate of gold as needed. The dollar gained a premium position as a reference currency, reflecting the shift in global economic dominance from Europe to the USA. Countries were prohibited from devaluing their currencies to benefit their foreign trade and were only allowed to devalue their currencies by less than 10%. The great volume of international Forex trade led to massive movements of capital, which were generated by post-war construction during the 1950s, and this movement destabilized the foreign exchange rates established in the Bretton Woods Agreement.1971 heralded the abandonment of the Bretton Woods in that the US dollar would no longer be exchangeable into gold. By 1973, the forces of supply and demand controlled major industrialized nations' currencies, which now floated more freely across nations. Prices were floated daily, with volumes, speed and price volatility all increasing throughout the 1970s, and new financial instruments, market deregulation and trade liberalization emerged.The onset of computers and technology in the 1980s accelerated the pace of extending the market continuum for cross-border capital movements through Asian, European and American time zones. Transactions in foreign exchange increased intensively from nearly $70 billion a day in the 1980s, to more than $1.5 trillion a day two decades later.Online Forex Trading Strategies

There are many ways to trade forex. Some traders practice "day trading", which means that they open and close positions in the same day. Some even open positions only for a few minutes. Others prefer to trade over several days, while some make deals over several weeks and even months. Depending on your trading profile, you will build your strategy either according to technical or fundamental analysis or both. Whatever strategy you choose, Finotec has a wide range of tools at your disposal: RSI, Bollinger, MACD, daily reports, and many more

What is Forex Trading

Forex trading also known as currency trading refers to a series of transactions on foreign exchange markets used by investors for speculative or hedging purposes. A basic forex transaction consists in the simultaneous buying and selling of one currency against another. Currencies are thus traded in pairs (majors or crosses) for instance: the Euro against the US Dollar (EUR/USD) or the British Pound against the US Dollar (GBP/USD). For example, buying the pair EUR/USD at 1.3305 means that you need 1.3305 USD to buy one euro.Trading forex can also be described as speculating on the direction of one currency against another. You make profit when the market moves in your favor and you lose if the market moves against you. For example, you'll buy EUR/USD if you think that the Euro will strengthen against the US Dollar. Conversely, if you think the Euro will weaken compared to the US Dollar, then you will sell EUR/USD.Although it may seem easy at first glance, there is much more to forex than meets the eye. Predicting market moves is a complicated matter and that's why Finotec has its own online forex Education Center where you can learn Forex. With Finotec, you may also practice online trading by opening a Forex Demo Account. The simulation platform will allow you to trade with virtual money in real market conditions. Once you have acquired the skills to trade, use our wide range of tools and indicators to make wise and informed decisions for successful online forex trading

Subscribe to:

Comments (Atom)